Voters residing in Mercer County, New Jersey, who have experienced a sharp increase in their property taxes could potentially upend this year’s gubernatorial election in Republicans’ favor. Although Democrats enjoy a significant voter registration advantage in the county and statewide, recent trendlines suggest beleaguered taxpayers may be ready to end Democrats’ one-party rule.

If not, the financial pressure will become increasingly untenable in the next few years.

Middle-class families and seniors on fixed incomes who would prefer to remain in the place they’ve called home for generations get one more bite at the apple on Nov. 4 when they elect their next governor. (RELATED: Americans Are Fleeing Blue States in Droves)

There are currently 11 candidates from both parties competing in the June 10 primary. But thus far, none of them have directly addressed the 22 percent property tax increase that hit residents of the capital county last summer. The average annual property tax for state residents now tops $10,000, which is a record high.

Ewing Mayor Bert Steinmann, a Democrat, fixed the blame for the 22 percent tax increase now in motion squarely on Mercer County officials in a message to residents. The Board of County Commissioners is responsible for reviewing and approving the budget that led to the 22 percent increase. I asked Mercer County Executive Dan Benson, a Democrat, which county officials approved the tax increase, and what public records, if any, from the county commissions and the taxation board document that increase. The commission itself and the county Board of Taxation should have some answers.

In his response, Benson correctly pointed out that under the prior administration, the State Comptroller’s Office found that Mercer County had improper policies in place impacting the county’s finances. The investigation also found that Dave Miller, the former chief financial officer, lacked the proper credentials for his position.

That’s what you call a clown show.

“This led to a whopping $4.5 million fine by the IRS and the loss of over $10 million in state aid, among other negative impacts,” Benson explained. “I knew our first budget would be challenging,” he continued. “We completed the long overdue 2022 audit and found over $10 million in deferred charges (spending from prior years that were not paid for) and $12.5 million in one-time federal American Rescue Plan funding used to plug their budget. These 2 items alone account for over 2/3 of this year’s tax increase. Other systemic issues like unsustainable increases in health care, prescription, and insurance costs make up parts of the rest of the increase.”

Clearly, there are festering financial holes that predate Benson’s time in office. But Richard LaRossa, a former Republican state senator representing parts of the county, sees another problem that the upcoming election could potentially fix.

“When you have one-party rule, no matter which party it is, there is a certain lack of accountability, and you don’t have what I call a positive friction that comes from having checks and balances,” LaRossa said. “We still don’t really know who approved the tax increase or what process was used.”

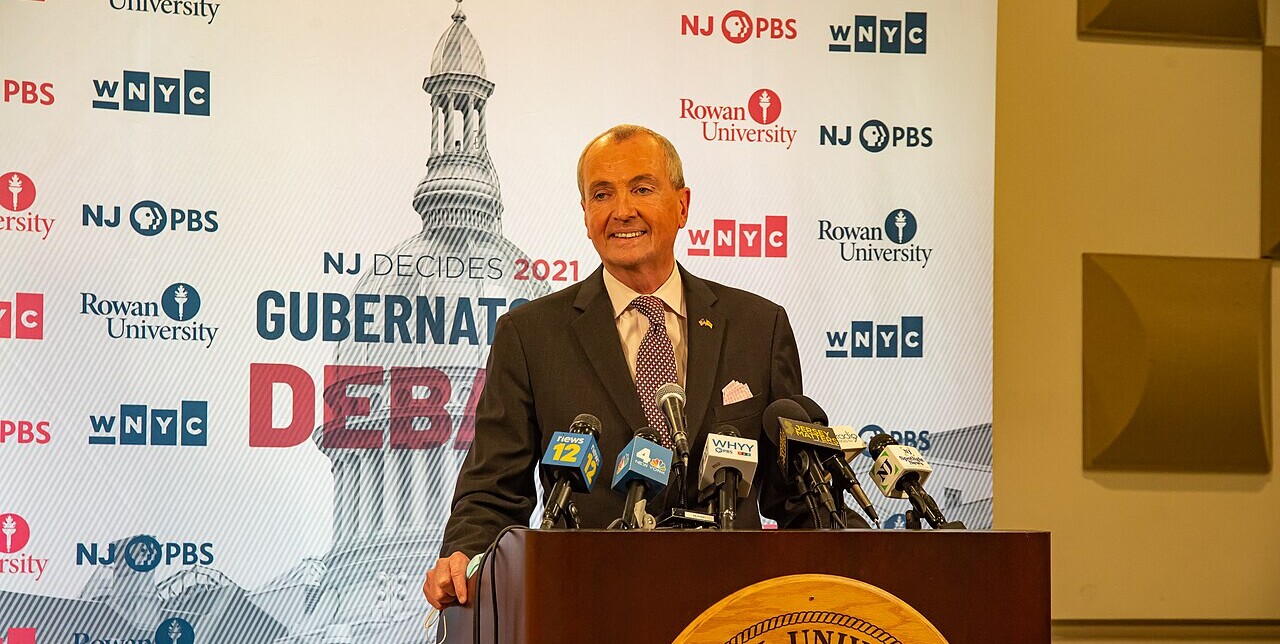

Under former Republican Gov. Chris Christie, a statutory property tax cap was passed in 2010, limiting annual increases to 2 percent. But as the Wall Street Journal reports, Gov. Phil Murphy, a two-term Democrat set to leave office next January, has already taken steps to evade the cap.

Benson explained that Mercer County remained under the cap using the state formula. LaRossa is not convinced everything is on the up and up. He sees “a massive” and “potentially illegal tax increase” at work that should be the focus of gubernatorial campaigns. LaRossa also said his most recent escrow notice went up $300, which comes out to a $3,600 annual increase.

This follows on the heels of the 22 percent tax increase the Ewing mayor blames on the county.

“I think the 22 percent increase was done illegally,” LaRossa said. “Republican candidates should be screaming about this.” There are several key questions about the increase that remain unanswered. “Who approved the increase? Was the county’s taxation board even involved? Or did the commissions just go ahead and approve the increase?”

Whoever was complicit in the decision to go above the 2 percent cap “broke the law,” in LaRossa’s estimation. He also suspects the budget gap that triggered the tax increase might be larger than what Mercer County commissions have acknowledged. If the dollar amount of the tax increase comes out higher than the $4.5 million IRS fine, LaRossa said that would serve as a strong indication that more money went missing during Miller’s tenure than what Mercer County officials have acknowledged.

Democrats hold a 896,350 voter registration advantage over Republicans in New Jersey. That’s down from more than a million a few years ago as Republicans have been making steady registration gains in the past few years. There’s also a large block of unaffiliated voters that is roughly even with the number of Democrats.

The state suddenly appears more competitive.

Donald Trump came within six points of winning the state against Kamala Harris in last year’s presidential race. In 2021, Republican Jack Ciattarelli, a former assemblyman and businessman, nearly unseated Murphy in a surprisingly close race. Ciattarelli is among the candidates again this year. The other two serious contenders in the Republican primary are Bill Spadea, a Mercer County-based radio personality, and Jon Bramnick, a state senator representing parts of Morris and Middlesex Counties.

Tax revolts are not new to New Jersey. After former Democratic Gov. Jim Florio pushed through a record tax hike in the early 1990s, a citizen revolt called Hands Across New Jersey (HANJ) propelled Republicans into legislative majorities. Florio also lost his bid for re-election.

By seizing on the questionable legalities of the recent tax hike, the Republican candidate for governor could possibly pull in enough Democrats and unaffiliated voters to win statewide.

It’s happened before.

Kevin Mooney is a senior investigative researcher for Restoration News.

READ MORE from Kevin Mooney:

Getting Back to an ‘America First’ Energy Policy

The EPA’s ‘De Facto EV Mandate’ Faces Potential Supreme Court Scrutiny