Illinois lawmakers smartly capped end-of-career salary bumps for state employees in an effort to combat ballooning, budget-busting pension increases, but teachers unions are fighting against the policy.

In 2005, legislators limited annual salary increases to 6 percent, and reduced that number to 3 percent this year. Teachers unions in Illinois have circulated petitions that have collected more than 15,000 signatures opposing the recent tightening. Those unions argue the limits now barely cover inflation and discourage teachers from adding extra-paying duties to their workload, such as coaching.

But prior to the efforts of the Illinois Legislature, teachers and other public employees could get significant raises as they neared retirement that resulted in much larger pensions after they stopped working. That’s because the pension formula only accounts for the top few years of income a person earns while employed with the state rather than an average income during the entire length of service. It’s a common problem across the nation, and one of myriad reasons the taxpayer burden for public-sector retirement costs have become a financial crisis across the United States.

Illinois Rep. Will Davis, D-Homewood, who chairs the state House education appropriations committee, told NPR the cutbacks weren’t easy, but were necessary for the overall financial strength of the state.

“I mean, things like this are tough conversations. But you know there’s also a manner in which we also have to look at the long-term viability of our state,” he says. “Not everybody’s in favor of raising taxes for the things we want to pay for. Sometimes we do have to make relatively tough decisions, and this fits into that category.”

State lawmakers have also kicked the can down to the local level. Sen. Elgie Sims, D-Chicago, said local districts can hand out bigger pay increases, but they must fund the additional pension costs at themselves.

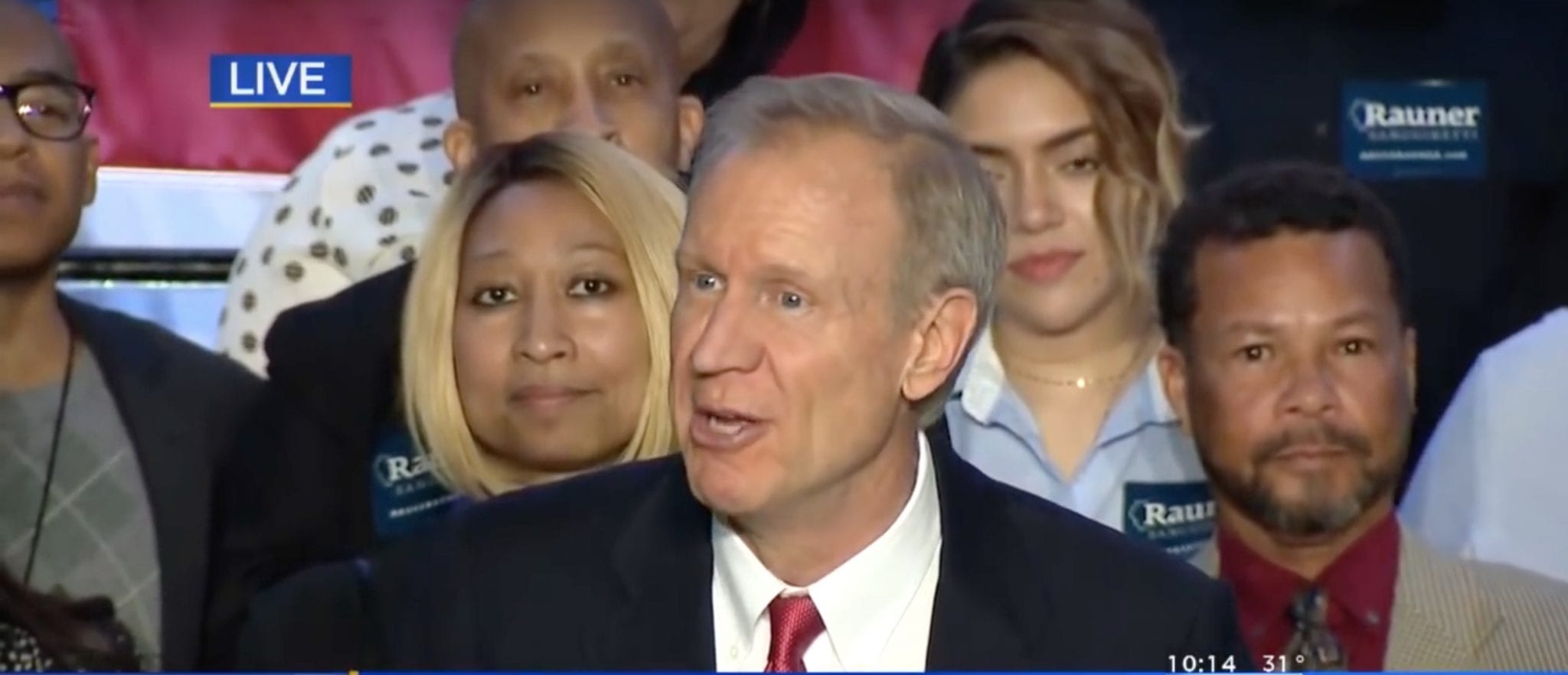

Republican Gov. Bruce Rauner has suggested further shifting pension costs to local school districts or decreasing the salary increase cap to 2 percent as a means of further combating the growing pension issue.

A bill was sent to Rauner’s desk in late June that would raise the minimum salary of teachers to $40,000, another move designed to decrease the late-career salary boosts.

Illinois continues to be ground zero for the debate about unions, pensions, and other taxpayer costs following the recent landmark U.S. Supreme Court ruling in Janus v. American Federal of State, County and Municipal Employees that prevents public workers from being forced to join unions by paying “fair share” fees that help fund collective bargaining.

Rauner was the lead in that fight and is taking heat from salty unions in the wake of the SCOTUS decision.

“I think we’ve all collectively done a good job of defining the governor and his ambition to take away collective bargaining, take away protection for injured fire fighters, reduce retirement security. And because they see the hypocrisy in his attempting to portray himself as the champion for working people, they looked at this decision and said, ‘This isn’t right. This is going to weaken my position as a firefighter, a teacher, a state worker,’” said Associated Fire Fighters of Illinois president Pat Devaney.

Pity those poor workers. In 2015, Reboot Illinois examined pensions and calculated the average value of a husband and wife who were both 58 years old and public-sector workers — the theoretical husband worked 30 ½ years as a firefighter before retiring, while the theoretical wife served 33 years as a teacher. The combined value of their pensions over the course of their retirement years was $3.7 million.

WTTW reports that Democratic majority states with strong union presences are discussing or close to passing laws that would counteract the Janus decision. These include allowing unions to stop extending all benefits to non-members, making it easier to recruit new members and keeping secret the contact information of public employees so they can’t easily be contacted by non-union, outside groups.

Honestly, these aren’t unreasonable measures, just as SCOTUS made a wise decision in protecting the free speech of public workers. If public employees don’t have to pay fair-share fees, they shouldn’t enjoy the fruits of the unions’ efforts, and regulations shouldn’t increase the difficulty of joining a labor union. Let people have the choice to join unions or turn them down, just as long as the decision is theirs to make.