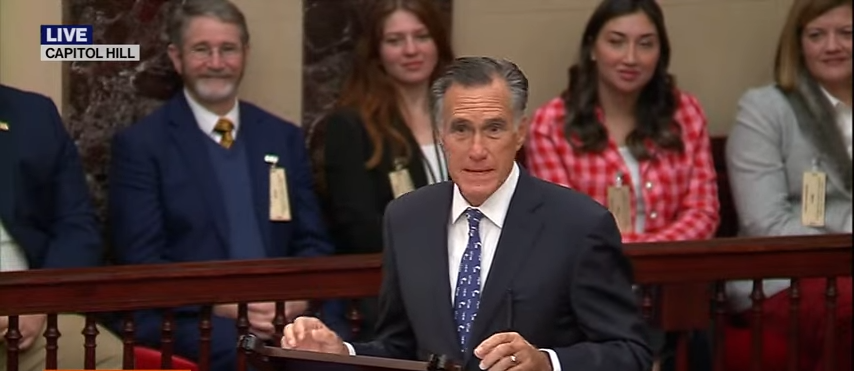

There is something emotionally satisfying about watching a wealthy person call for higher taxes on people like himself. It feels civic-minded, even noble. A recent commentary by former Utah senator, Massachusetts governor, and Republican presidential nominee Mitt Romney fits squarely into this tradition. Faced with a looming fiscal cliff, Romney concludes that entitlement reform is unavoidable and that higher taxes on affluent Americans must be part of the solution.

Don’t be fooled, though. Yes, the status quo is unsustainable, and pretending otherwise is reckless. But taxing the rich can’t meaningfully solve our underlying fiscal problems. Worse, pursuing that illusion risks making those problems harder to fix while foreclosing opportunities for the next generation.

Start with a basic arithmetic problem that never goes away: High-income households already shoulder a disproportionate share of the federal income-tax burden. The top 1 percent pay roughly 40 percent of income-tax revenues; the top 10 percent pay well over two-thirds. And when taxes and other transfers of wealth are factored in, the system has become increasingly progressive over time.

Whatever one thinks about fairness, this fact has huge implications for collecting revenue. There’s simply not enough taxable income at the top to finance a government built around large, universal, middle-class benefits.

Romney proposes raising revenue by removing the cap on payroll taxes, taxing assets more heavily at death, ending like-kind exchanges in real estate, limiting state and local tax deductions, and closing the carried-interest preference. None of these ideas are new. Their revenue effects have been studied repeatedly. Even under optimistic assumptions, their combined yield over a decade amounts to only a fraction of projected deficits. Trillions sound impressive in isolation, but against tens of trillions in red ink, they’re a rounding error.

There’s an even deeper problem with the “tax the rich” impulse. It assumes that those being taxed will pay the full cost without simply reducing their tax exposure. Taxes change behavior. They alter investment decisions, career choices, and the accumulation of human capital. They nudge employers toward retirement rather than toward another round of hiring.

And higher marginal tax rates at the top do not just affect today’s wealthy people; they shape the incentives of tomorrow’s entrepreneurs, engineers, doctors, and business builders.

It’s easy to say “tax me more” once you’re already rich — with wealth already built, diversified, and largely insulated.

This is where moral posturing a la Romney becomes especially troubling. It’s easy to say “tax me more” once you’re already rich — with wealth already built, diversified, and largely insulated. But if such a system had been imposed earlier, it would have reduced the likelihood that as many individuals would have become wealthy in the first place.

In other words, the call to tax the rich today makes it harder for young people to become rich tomorrow. Thanks a lot.

That matters not because everyone should be a billionaire but because economic mobility depends on the possibility of outsized success. When the returns on extraordinary or unique effort, risk-taking, and skill acquisition are diminished, fewer people invest in them. The evidence is clear that more progressive tax systems reduce incentives to accumulate human capital and expand businesses over the long run. These costs show up slowly — in lower productivity, slower growth, and fewer opportunities. But they do show up.

We should also not assume that new tax revenue would actually be used to reduce deficits. Especially because history suggests otherwise. When revenue rises, spending tends to rise with it, often by more than the increase in taxes. The promise that “this time is different” is commonplace, but it’s rarely been kept.

The real driver of today’s fiscal imbalance remains largely untouched: spending on entitlement programs whose costs grow automatically and whose benefits flow increasingly to people who are already financially comfortable. Romney is correct that payouts should be means-tested for future retirees. But the notion that we can’t tweak the benefits of the retired or near-retired is nonsense. Many of them don’t depend on Social Security for their retirement income and receive more than they paid in.

If wealthy Americans genuinely believe they should contribute more, they are free to do so today. The Treasury accepts voluntary payments. That’s a much better idea than using their resources to support policies that lock in a tax environment that prevents younger generations from building wealth in the first place.

The temptation to tax the rich is understandable. It feels fair. It feels painless. It allows us to postpone harder conversations. But feelings are not solutions. Such taxation will not stabilize government finances, and it will not restore confidence in the system. Worse, it risks turning a society that once rewarded ambition into one that quietly penalizes it.

READ MORE from Veronique de Rugy:

An Appreciation of What Makes America’s Generosity Possible

The Quiet Engine Behind Gen Z and Millennial Malaise

Giving Thanks for Our Sometimes-Maligned Constitution and Creed

Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com. COPYRIGHT 2026 CREATORS.COM