When you give someone welfare handouts and food stamps, you help him or her until the cash soon runs out. But when you create conditions that enable such people to obtain employment and to work gainfully, you help them and their future generations for life, even as you imbue them with dignity. People who live off public assistance know in their hearts and souls that they are not keeping up their end of the social bargain. As long as they have any dignity, they are burdened with shame. They are told not to be ashamed: “These are ‘entitlements’! You are entitled!” But people with self-respect know better. People who work and who pay income taxes, however modest those income taxes be, take pride in knowing that they are part of society’s solutions, not its problems.

To be sure, some people lack those abilities because of physical or psychological impairments that leave them unable to contribute, and conservatives commit to to their assistance. “For the poor shall never cease out of the land; therefore I command thee, saying, ‘Thou shalt surely open thy hand unto thy poor and needy brother, in thy land,’” says Deuteronomy 15:11. Indeed, it is part of the personal responsibility that a conservative bears to assist those truly unable to help themselves.

On its face, socialism sounds so fair: To each according to his or her need — and why not? Equality of results. Equality of incomes. No homelessness. Medicare for all. Let us briefly look more closely.

Guaranteed Equal Income and Taxing “The Rich” at 70 Percent

When people who perform services and tasks are guaranteed a certain income level, with certainty that they will not be fired or reduced in pay, they devote less intensity to their work because they know they will not face consequences for mediocrity. If this phenomenon is problematic at the supermarket checkout counter, it is dire when it reaches air-traffic controllers, commercial-vehicle drivers, and even school teachers entrusted with training the minds of the young. Capitalism and free enterprise motivate people to aspire, knowing that they must work harder and produce more effectively and efficiently to rise and be rewarded. It has been this effort to rise beyond one’s social and economic standing that has accounted for so much of the unique life advances that have come from American industry and entrepreneurship. Others — China, Japan, India — may steal American intellectual property and reproduce the products more cheaply, but the creative breakthroughs have come from America, driven by free-market capitalism. It is no coincidence that smartphones and the internet are associated with American names like Bill Gates, Steve Jobs, Mark Zuckerberg, and Jeff Bezos. In return, they became billionaires. Likewise, most of the world’s most remarkable medical drugs have come from American research and development. Americans are not genetically superior to others. Rather, the American free-market capitalist system that rewards endeavor, risk, independent thinking, and hard work accounts for the difference. If you ever have tried to win an award, to make a sports team, or to get a treat from a parent, you personally have experienced how you did better when you were not otherwise guaranteed a result.

You have a moral quandary: In a world of homeless people and starvation in Venezuela, how can it be right that some Americans are so greedy that they never stop pursuing wealth, even after reaching a billion dollars? I agree with you that they do not need it. But that is what drives them, just as other people are driven to attain certain other goals that make no sense to me, like competing in Olympic curling. I am a rabbi. What drives me is to learn and teach Torah. I also love to express myself in writing, so I write. Musicians — whether country artists or those in hip-hop or other genres — are driven to perform their craft. One person loves the cello, the next the viola. Some love to do woodwork or to work under their cars’ hoods. In the same way, many people are driven by the passion to “make money.” That is not my passion, and maybe it is not your passion, but it is their passion — just to keep making more money. Many of America’s main leftists — Bezos, Steyer, and Zuckerberg — are driven by the unquenchable thirst for more money. They live to make money.

Most of us do not live in their world and do not understand their single-minded materialist focus, but a good place for insight is the TV show Shark Tank. There you have Mark Cuban, Kevin O’Leary (“Mr. Wonderful”), Barbara Corcoran, Lori Greiner, Robert Herjavec, and Daymond John. These people are incalculably wealthy. But they live to make more money, so they invest in others’ ideas. They find the monetary risks they face no less exciting than do others who enjoy bungee-jumping, and they enjoy the intellectual challenge of evaluating an idea’s marketability just as scientists are intrigued by other intellectual challenges. Less-established Americans who harbor creative new ideas come to them and say, “This food or appliance or clothing or leisure activity will make all our lives better, but I don’t have the money to make my idea succeed. I need your money.” The investors listen and, motivated primarily by personal greed, decide whether to commit hundreds of thousands of their own dollars to one idea, then another. The investors never seem to run out of money for investing because they already are “too rich.” They already have accumulated so much money that they can invest endless millions in endless new ideas. The result: every time they put up more money to make even more money … all our lives improve. By contrast, if we were to tax their private “excessive” wealth at confiscatory rates, where would seed money come from for great new ideas and products?

From the government.

When the government invests in ideas, sometimes society hits a winner, but all too often government becomes surrounded by lobbyists and interest groups motivated by the politics of the idea rather than by its underlying market wisdom. Thus, under Obama, government gave more than $500 million to Solyndra for a climate-change proposal that advanced a political agenda. Half a billion dollars were lost. In California, the government undertook to build a high-speed rail line that made no sense but that was politically chic. In 2008, voters were told that the project would cost $40 billion. Four years later, the projection was raised to $68.4 billion. It now is priced at $77 billion, with expectations that the numbers will exceed $100 billion. There is more: Initially, a one-way ticket from Los Angeles to San Francisco was going to cost $55 per ticket. Now the estimate is $86 per ticket. It was estimated that the project would be completed by 2023. Now the expected completion date is 2033. The estimated number of expected passengers per year has dropped 67 percent. As a result, California now is moving towards ditching most of the project. Billions have been lost, and there is no high-speed rail to show for it.

Private billionaires, because they are driven not by politics but by their own greed to make more money and by their own caution not to lose money wastefully, direct investment capital to worthy projects that have high probabilities of succeeding. Thus free-market capitalism not only fuels the economy but also makes our lives better. If the government starts taxing private wealth at confiscatory levels, all of economic history teaches that the raised tax levels will not cause billions suddenly to pour in and pay for free services for everyone else.

Instead, here is what will happen:

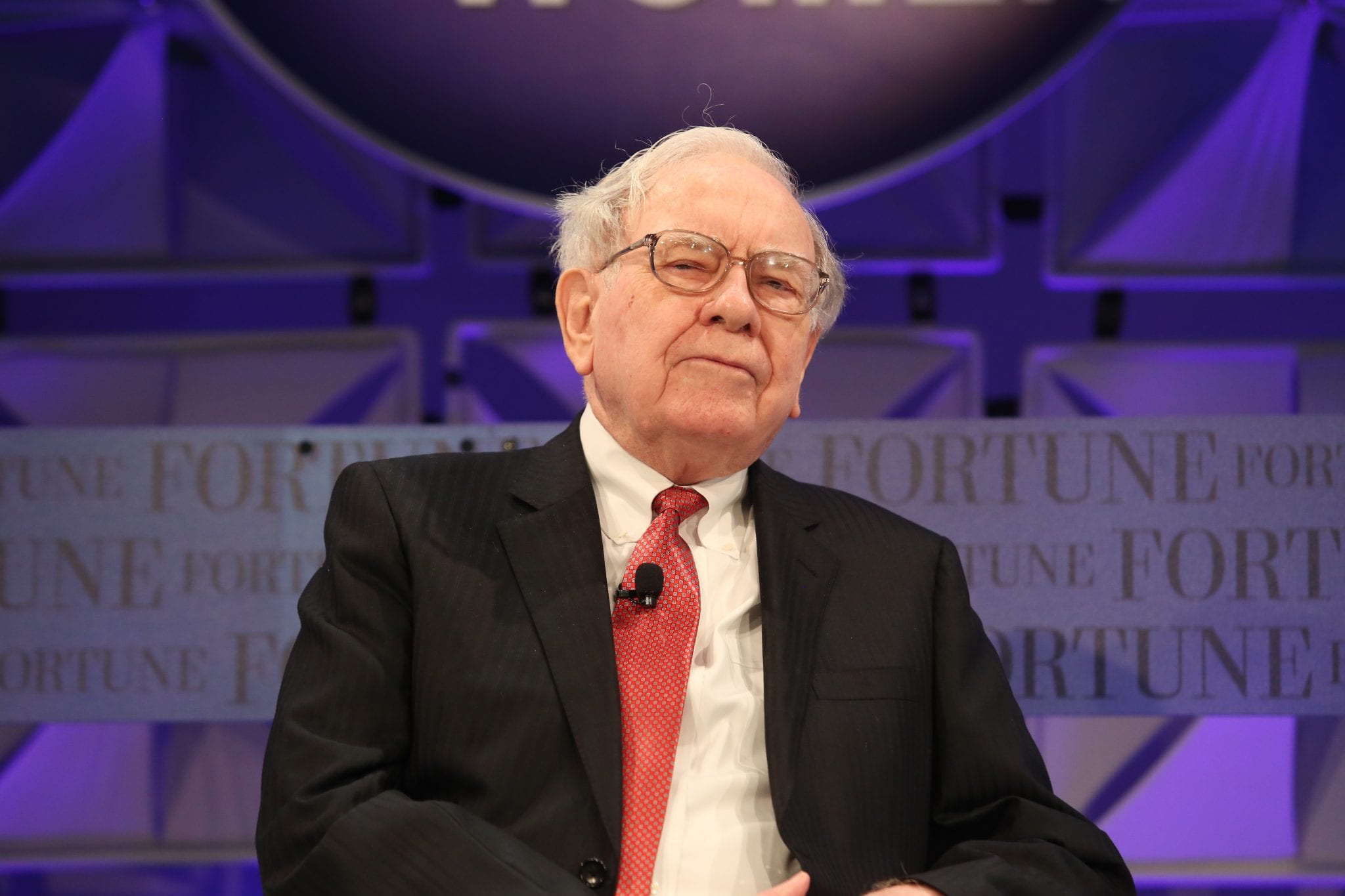

“The Rich” will retain the expert services of brilliant tax attorneys and accountants who will study the new laws and brilliantly will devise loopholes and exotic strategies by which to minimize or bypass new tax bites. As an example, General Electric made a $14.2 billion profit in 2010 and reportedly paid no taxes. The Alternative Minimum Tax (“AMT”) was created after it was learned that 155 of the country’s wealthiest families had paid no taxes; in the end, “The Rich” continued legally to dodge taxpaying while the AMT ended up ravaging the middle class. In similar fashion, Amazon paid no taxes in 2017 on profits of $11.2 billion. “The Rich” and their tax advisors enjoy endless strategies that the non-rich cannot fathom. They can move money out of the country to lower-tax havens. They can defer profits to later years or can recharacterize assets. They also buy politicians legally by contributing to their election campaigns; in return, their lobbyists help draft tax legislation. Thus, even while it seems that new laws are tightening tax loopholes, “The Rich” will not pay more because their lobbyists’ hidden loopholes assure safe havens. Warren Buffett endorsed Obama in 2008, saying it was unfair that Buffett’s secretary pays higher taxes than he does. But by 2019, after the Wasted Obama Decade, Buffett still was saying that he pays less in taxes than his secretary. It never changes, and it is not unique to either party. Wall Street capitalists hedge their bets, as do Silicon Valley billionaires, by contributing heavily to Democrats. Thus, Bernie Sanders and his wife are millionaires who own three houses, and Sanders jets around the country in private planes. Elizabeth Warren has solicited billionaires like Starbucks’ Howard Schultz for donations, and she has been able to get hundreds of thousands of dollars from individuals in securities and investment firms that specialize in protecting their customers’ wealth from higher taxes. Hillary Clinton was paid hundreds of thousands by Wall Street firms for secret fifteen-minute meetings behind closed doors that were characterized as “speeches” and “honoraria” but that really were payoffs to assure access to maximize their profits if she had won.

Any effort to reduce wealth of “The Rich” simply drives their assets into other vehicles and off-shore tax havens. Likewise, data reflect that even middle-class Americans flee high-tax states like Illinois, California (despite its great weather), and New York (despite its cultural offerings) for low-tax and no-tax states like Texas, Arizona, and Florida. If the middle class cannot get ahead because taxation policy keeps them locked at a level similar to lower classes, then middle-class people will work less hard and fewer hours, be less creative, strive less, and abandon that unique American spirit of entrepreneurship that has benefited the world so greatly under capitalism. That is how people are, and that is how you are and will be. You will want the best for your significant other, for your kids, and even for yourself.

That is why socialism never works. Why the more that California spends on social services, the greater the demand for even more such services, even as Hollywood flees to Georgia to make movies about California. The science is settled, from Russia to China to North Korea to Venezuela. It never works.