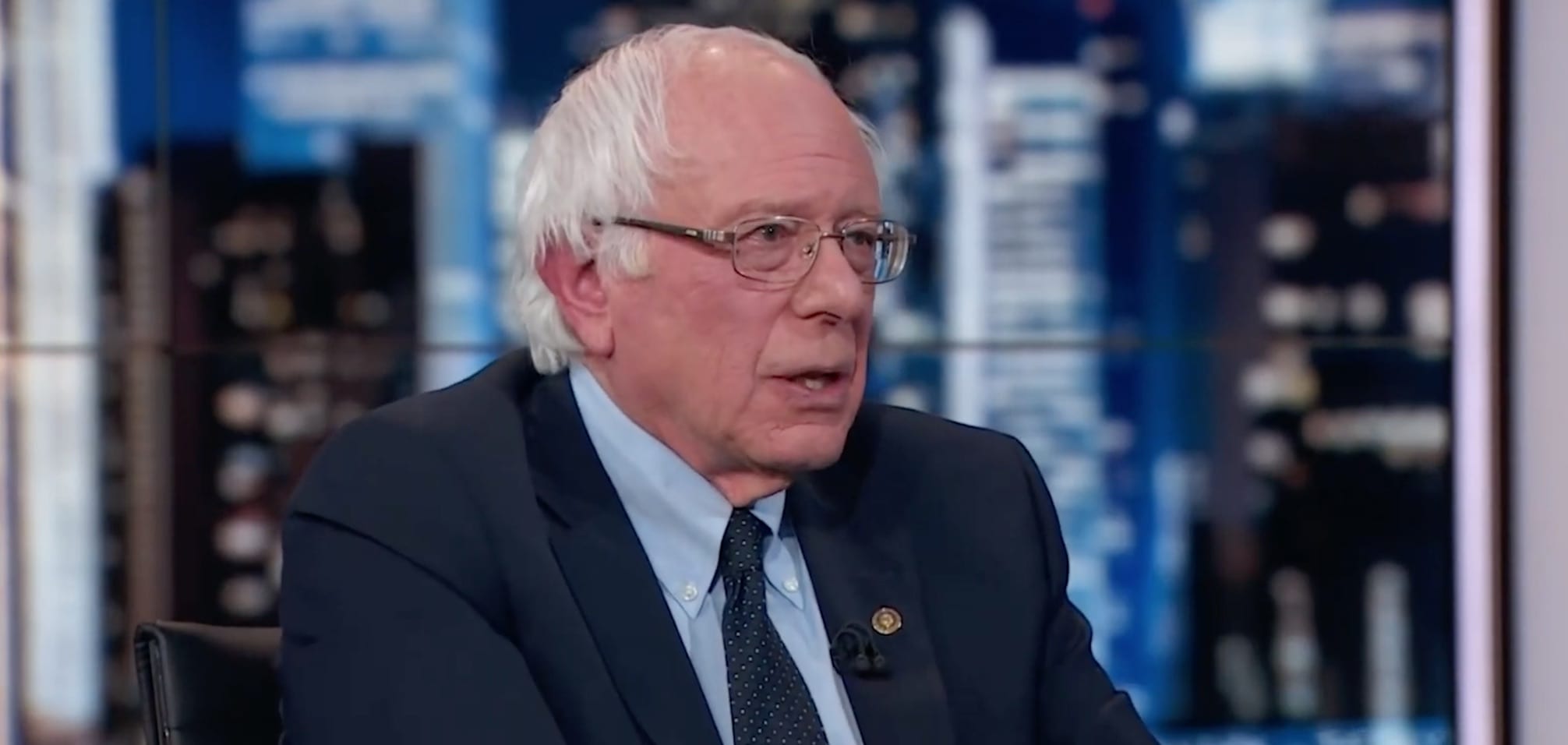

Bernie Sanders has agreed to release his recent tax returns and, while he was at it, confessed to being a “millionaire.” He got that way, he explained, by writing a best-selling book. You, too, could be a millionaire, he said, if you had written a best-selling book.

This sounds, somehow, like he is making excuses or apologizing or something. And the fact that he had to be pressured, more or less, into releasing his tax returns makes it seem as though he might have been trying to hide something. Or, at any rate, as though there is something in those returns that will prove embarrassing and might even jeopardize his chances in the struggle to become the Democrats’ nominee for President.

The question of whether or not Sanders would release those returns was treated as a matter of some urgency in the media. And the Democrats in Congress are, meanwhile, doing all they can to get President Trump’s tax returns made public and not because they will enhance Trump’s reputation for probity or support his boasts about just how much money he has made.

The battles of the tax returns make good material for the media but when one thinks about the thing, it begins to occur that the focus is all wrong. It isn’t the releasing of the returns that should be controversial or even scandalous. Nor, for that matter, should the content of the returns be. It seems unlikely that either President Trump or Senator Sanders will be exposed for having violated the law. Accountants will have made sure of that as, most likely, will the auditors at the IRS.

But some of what will be revealed may prove to be embarrassing. And that, really, is the point. Sanders the Socialist may have been secretly committing capitalism in some form and Trump may turn out to be nowhere near as rich as he’d like to world to think he is.

The exposure of these things will make for great fun in the overlapping media and political universes. Meanwhile, the true scandal will go on.

Any indignation inspired by these candidates’ tax returns is as nothing compared to how we should all feel about the entire tax system, which might be seen as the perfect Washington creation. That is: unfathomably complicated, tricked out with favors to special interests, and impossible to reform.

Whatever “loopholes” Sanders or Trump — or both — may have taken advantage of, they were not put into the code by mistake. They got there by an act of Congress. And that Congress was influenced by the great Washington lobbying machine that exists to create and preserve loopholes. Among other things.

A couple of years ago, Senator Roy Blunt of Missouri claimed that “Our tax code has nearly doubled since 1985.”

The assertion was immediately “fact checked” by PolitiFact Missouri, which reached the unsurprising conclusion that Blunt had it right. And the length, of course, is only a part of the problem. There is also the complexity which is enough to drive an ordinary citizen, who is trying to file, barking mad. It also makes for an industry of preparers who are all too happy to help… for a small fee. And, also, a legion of accountants whose fees are anything but small but whose skill is in finding the creases in the law that allow people like Bernie Sanders to keep a little more of their hard-earned millions.

The IRS routinely gets graded at the bottom of the class in those “customer satisfaction polls” and no surprise there. But, again, it isn’t the agency or the people working for it that are the root of the problem. It is a system that Congress cannot bring itself to reform or, better, eliminate in favor of something simple and clean.

The proposed alternatives — especially the “flat tax” in one of its many variations — are routinely dismissed as being somehow “unfair.” Which leads one to ask, “And this system is?”

Most of those alternatives have, at least, the virtue of simplicity, unlike the present system which even those paid to administer it have difficulty comprehending.

And, then, it does seem that the present system doesn’t test all that high on “fairness.” There are ways to take advantage of its complexity if you can afford to hire the right people to manage your money and do your returns. It will be interesting to see what strategies, if any, Bernie Sanders followed in this regard.

Whatever we learn about from his returns — and the President’s, if we ever see them — any embarrassments, outrages, or scandals will soon pass.

And IRS and the tax code will still be standing there. Invulnerable.